The affirmation reflects Fitch’s view of ‘Virtually certain’ extraordinary support from Kazakhstan (BBB/Stable) for KHC. This is due to its strategic importance for the country as the key housing development operator and core consolidator of the housing sector.

KEY RATING DRIVERS

Support Score Assessment ‘Virtually certain’

We consider that extraordinary support from Kazakhstan to KHC would be ‘Virtually certain’ in case of need, reflecting a support score of 45 (out of a maximum 60) under Fitch’s Government-Related Entities (GRE) criteria. This reflects a combination of responsibility to support and incentive to support factors assessment as below.

Responsibility to Support

Decision Making and Oversight ‘Very Strong’

KHC is wholly-owned by the state via JSC National Management Holding Baiterek (Baiterek, BBB/Stable). Fitch links KHC directly to Kazakhstan as it is a public-mission GRE with a strong policy role. Baiterek acts in lieu of the government and approves KHC’s budgets, borrowing decisions, investments and dividend policy.

KHC continuously cooperates with government agencies and committees in its day-to-day activities and regularly provides reports to ministries and other state entities. The company conducts its activities mainly under government programmes and its key performance indicators are dominated by socially important indicators like volume of housing constructed using KHC’s instruments.

Precedents of Support ‘Strong’

KHC benefits from low-cost long-term state funding for the implementation of state programmes. The main forms of funding are loans and bonds from Baiterek, which represent around 94% of KHC’s debt. More than half of these funds were provided under a large state anti-crisis programme in 2020-2021, and the rest under various housing programmes. In 2022-2023 direct state support was limited and KHC mainly used previously acquired funds on a revolving basis.

KHC generates moderate profit and pays dividends to Baiterek annually. In 2024 the government decided to provide additional KZT272 billion to KHC for the buyout of local and regional government bonds via a loan sourced from Sovereign Wealth Fund Samruk-Kazyna JSC (BBB/Stable).

Incentives to Support

Preservation of Government Policy Role ‘Very Strong’

KHC’s socio-political importance is underlined by its key role in state housing development and a lack of direct substitutes. Affordable housing is high on the government’s political agenda. At end-2023, average per capita living space in Kazakhstan was about 23.9sq m (end-2022: 23.4sq m), significantly below the international standards of at least 30sq m.

The company stimulates housing supply by extending funds to residential construction companies as well as providing them with subsidies and guarantees. KHC estimated that about 20% of new residential apartments in Kazakhstan in 2023 were built with the help of its instruments (2022: 27%). KHC also stimulates demand for housing, but this is on a smaller scale, mainly through social rental contracts with an option of buy-out.

Contagion Risk ‘Strong’

KHC is an important participant on the domestic bonds market. In addition to regular bond issuance, it invests in local and regional government bonds, thus providing long-term funding to the market. Exposure to international funds is limited to loans from Eurasian Development Bank (EDB), which represent around 1.5% of KHC’s debt. Fitch assumes that a default of KHC, as a high-profile entity, would have a significant impact on the availability and cost of domestic financing for other GREs in Kazakhstan.

Standalone Credit Profile

KHC’s Standalone Credit Profile (SCP) is unchanged at ‘b+’ under Fitch’s Non-Bank Financial Institutions Rating Criteria. KHC’s SCP is constrained by its business profile, limited franchise and high concentration on both sides of the balance sheet. KHC sticks to its policy role and its performance relies on cheap/subsidised funding from the parent group. The company operates as an instrument providing financing to local municipalities and to a lesser extent,real estate companies to facilitate affordable housing development in Kazakhstan.

Investments in securities of local municipalities comprised 46% of KHC’s total assets at end-1Q24. These are spread across issuers but we assess the correlation of credit risk as high, given the proximity to the state. There were no delinquencies in this portfolio at end-1Q24. The loan portfolio was a modest 17% of total assets and included housing loans and financing leasing to individuals as well as to construction companies, all aimed at providing affordable housing at subsidised rates.

These loans are of weak quality with stage 3 delinquencies totalling 6% at end-1Q24, which is a marked improvement from 2022, when impaired loans ratio reached 9%. The stage 3 loans were only partially covered with loan loss reserves by 11.4% at end-1Q24.

KHC’s capitalisation and leverage position is strong, with the gross debt/tangible equity ratio at 4.2x as of end-1Q24. Throughout 2020-1Q24 the company has maintained significantly lower leverage than the internal cap of 7x. In 2023 KHC distributed 70% of previous year profits (2022: 70%).

Funding is provided at subsidised rates and the company benefits from a credit line from Baiterek. The company has small placements in public markets. However, this it is immaterial in relation to total funding.

KHC’s cash liquidity position is quite high as a result of early paid-off investments in local municipalities (KZT533 billion as of end-1Q24) and comfortably covers debt maturing until end-2025.

Derivation Summary

Fitch looks through the chain of control and classifies KHC as a public-mission GRE with strong links to Kazakhstan, despite its indirect state ownership through Baiterek. Fitch’s assessment of support rating factors under its GRE Criteria resulted in a score of 45 out of a maximum 60 and corresponding ‘Virtually certain’ assessment of extraordinary support from the government. KHC’s ‘b+’ SCP is five notches below Kazakhstan’s rating. Together these assessments lead to the equalisation of the IDR with the government’s at ‘BBB’.

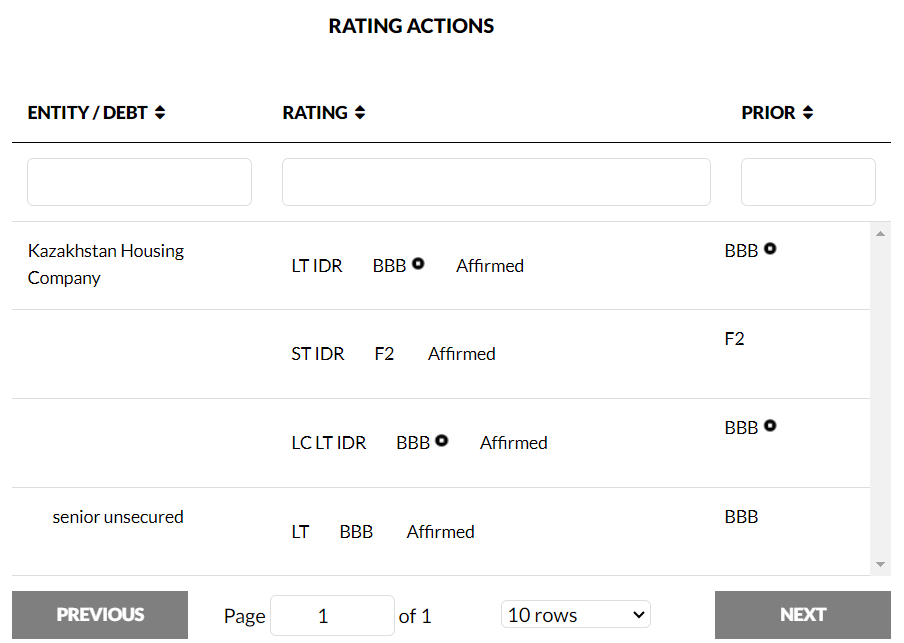

Short-Term Ratings

The ‘F2’ Short-Term IDR reflects Fitch’s GRE Rating Criteria approach. KHC’s Short-Term IDR is equalised with the sponsor’s. This reflects our view that the provider of support is linked to or represents the state, has strong liquidity and would be willing to support the state-owned entity, in case of need.

Debt Ratings

The debt ratings are at the same level as KHC’s IDRs.

Issuer Profile

KHC is a main facilitator of affordable housing for Kazakhstan. One of its key functions is providing support to residential construction via the buyout of local bonds as well as providing guarantees and subsidies to developers, stimulating housing supply. KHC also supports demand in the housing market by provision of social rental housing with buy-outs, repurchase of commercial banks’ mortgages and other channels.

Liquidity and Debt Structure

KHC’s debt structure is weighted towards bonds, which comprised 67% of its total debt at end-2023. The majority of the issued debt (94%) is owned by Baiterek and primarily sourced from Kazakhstan National Fund and National Bank of Kazakhstan. Another 32% of debt is represented by loans from Baiterek. The residual 2% is direct funding from the national government, the capital city and EDB.

Fitch expects KHC’s debt structure will continue to be heavily dominated by low-cost state-related funding over the medium term (95% of total debt as of end-2023). The maturity profile of KHC’s debt stretches to 2052, with no significant refinancing risks over the medium term.

RATING SENSITIVITIES

Factors that Could, Individually or Collectively, Lead to Negative Rating Action/Downgrade

– A downgrade of Kazakhstan’s IDRs

– A dilution of linkage with the sovereign or weaker incentives to support leading to a reassessment of key risk factors

Factors that Could, Individually or Collectively, Lead to Positive Rating Action/Upgrade

– An upgrade of Kazakhstan’s IDRs

ESG Considerations

The highest level of ESG credit relevance is a score of ‘3’, unless otherwise disclosed in this section. A score of ‘3’ means ESG issues are credit-neutral or have only a minimal credit impact on the entity, either due to their nature or the way in which they are being managed by the entity. Fitch’s ESG Relevance Scores are not inputs in the rating process; they are an observation on the relevance and materiality of ESG factors in the rating decision. For more information on Fitch’s ESG Relevance Scores, visit https://www.fitchratings.com/topics/esg/products#esg-relevance-scores.

PUBLIC RATINGS WITH CREDIT LINKAGE TO OTHER RATINGS

KHC’s IDRs are directly linked to Kazakhstan’s IDRs

References for Substantially Material Source Cited as Key Driver Rating

The principal sources of information used in the analysis are described in the Applicable Criteria.