STB issue loans at their own expense at an interest rate not exceeding the level of the base rate of the National Bank of the Republic of Kazakhstan by more than 5%, effective on the day of the decision on subsidizing. Thus, commercial loans of STB for housing construction purposes should not exceed 19% per annum.

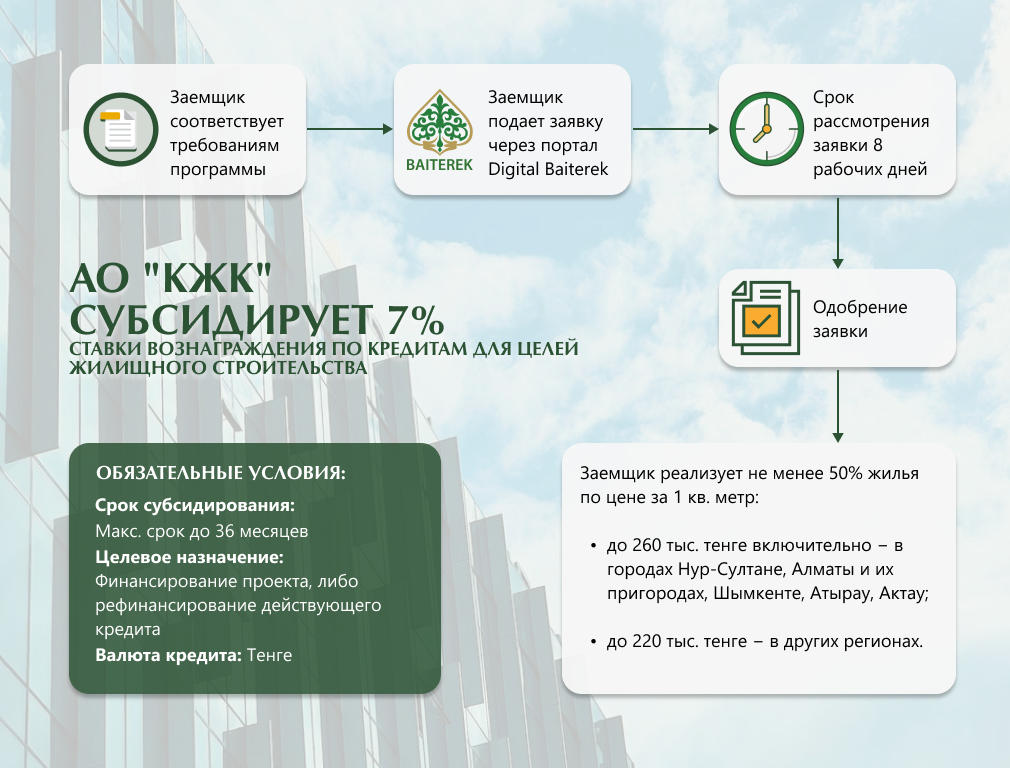

Kazakhstan housing company, in turn, subsidizes 7% per annum of the interest rate on these loans. The unsubsidized part of the interest rate on the loan is paid by the developer.

It is fashionable to apply online on the Digital Baiterek portal: https://digital .baiterek.gov.kz/subsidizing-application

The Rules of subsidizing and the necessary package of documents can be found at the link: https://adilet.zan.kz/rus/docs/V1700014765(Order of the Minister of National Economy of the Republic of Kazakhstan dated January 31, 2017 No. 35)

The service is fully automated. The deadline for consideration of the application is 8 working days. List of required documents:

1) application form for a subsidy in accordance with Annex 1-1 to the Rules https://adilet.zan.kz/rus/docs/V1700014765(Order of the Minister of National Economy of the Republic of Kazakhstan dated January 31, 2017 No. 35)

2) description of the project being implemented (formed in any form with the application of permits for the construction of the project, business plan);

3) a letter from the STB with a positive decision on the possibility of providing (refinancing) a loan for the implementation of the project;

4) conclusion of a comprehensive non-departmental examination;

5) information about the object (presentations, promotional materials, apartment layout, area and number of apartments), including in electronic form.

Mandatory conditions for the borrower:

- purpose – project financing (loan refinancing);

- the currency of the loan is tenge;

- the maximum subsidy period is up to 36 months inclusive.

For reference: New loans include those previously issued by the STB within 18 months prior to consideration by the financial agent. Loans previously issued to the STB with a term of 18 months on the day of applying to the STB are allowed to be refinanced as part of the subsidy.

Targeted spending of the loan is allowed for:

1) payment of construction and installation works, project management costs, author’s and technical supervision services;

2) payment of other expenses related to the implementation of the project, including advertising expenses, maintenance of management personnel, utilities and telecommunications services, rent payments, expenses for the production of technical passports for quality control, laboratory tests, taxes and other mandatory payments to the budget, mandatory pension contributions and mandatory professional pension contributions, contributions for compulsory social health insurance to the Social Health Insurance Fund.

A private developer offers at least 50% of housing at a fixed selling price per 1 square meter:

- up to 260 thousand tenge inclusive – in the cities of Nur-Sultan, Almaty and their suburban areas, Shymkent, Atyrau, Aktau;

- up to 220 thousand tenge – in other regions.

A private developer sells housing through direct sales, loans from «Otbasy Bank” JSC, second-tier banks, “ 7-20-25” mortgage program and the programs of subsidiaries of “Baiterek” NMH JSC.

Press service

Kazakhstan Housing Company JSC

+7 7172 797575, ext. 2394

pr@khc.kz, www.khc.kz